While review websites can be helpful in helping you choose the best credit card, the best saving account etc with their extensive research - without access to your credit score and your financial documents – it might not be very helpful when it comes to taking a personal or business loan.

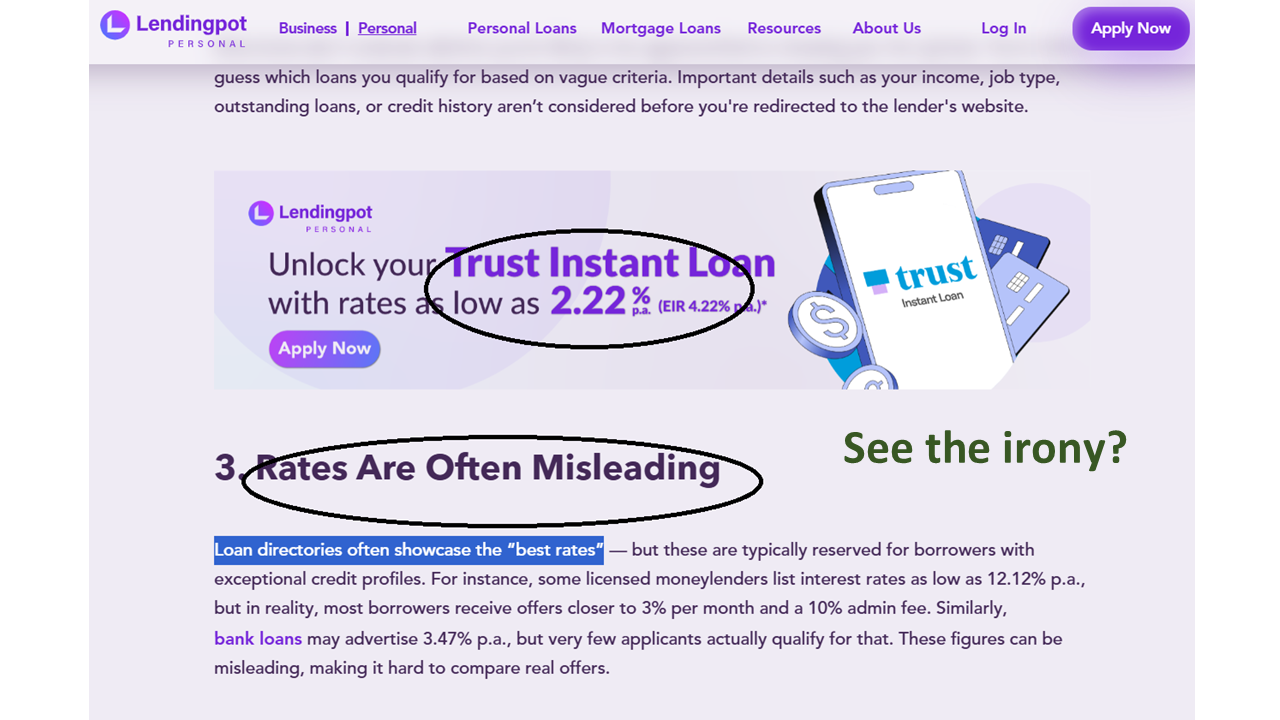

How much can you borrow, the duration and the interest rates you will be paying vary from individual to individual with many factors taken into consideration. “Up to 5 million”, “as low as 1%” means nothing if they do not apply to you. And without applying directly to the banks and providing them with all the documents required to make an assessment, you just will not know for sure what can they offer you and who has the better offer - which you can easily do so via our platform and reach multiple lenders directly with just one submission.

Well, you could also use a broker. Especially if you have a good one you can trust. I mean why go to all the trouble when someone can do that legwork for you. A good broker or loan consultant can really have the work cut out for you, saving you dozens of hours of navigating each bank’s website to apply and later trying to compare the offers. Just be sure to scrutinize and compare your broker’s contract before signing it and negotiate for lenders that you can speak to yourself not forming part of the agreement. You can also learn more about best practices when working with brokers in another article of ours.

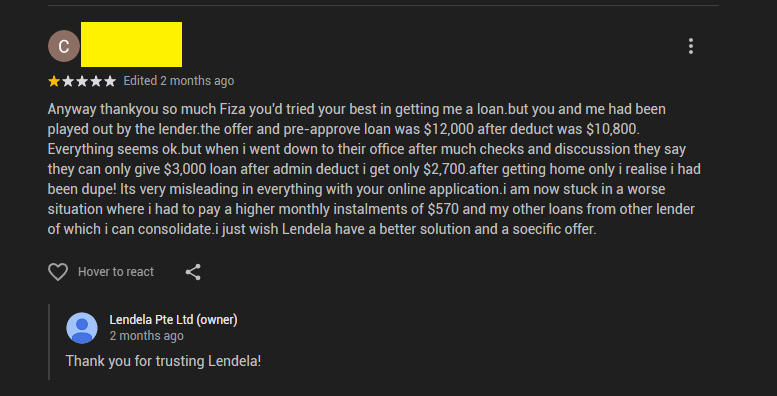

But what if you do not get a good broker? When you engage a human entity, it still ultimately boils down to your relationship with them or their professionalism and their relationship with their RM. Our platform is fully automated and handles all borrowers equally regardless of much they are trying to borrow. In addition to being something you can access 24/7 at your convenience, instead of receiving calls during meetings or dinners, you also decide and know exactly which lender receives your information.